Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Taxes are mandatory financial charges imposed by governments on individuals and businesses to fund public expenditures and services. These charges are levied on income, wealth, purchases, property, and various other activities and transactions. Taxes serve as a primary source of revenue for governments to finance infrastructure development, social welfare programs, defense, and other public services. The tax system varies across jurisdictions, and specific tax laws dictate the rates, exemptions, deductions, and collection methods.

Who is required to file tax taxes?

The obligation to file taxes varies by country and individual circumstances. In the United States, for example, individuals generally must file taxes if their income exceeds a certain threshold, dependent on factors such as filing status, age, and type of income. Additionally, individuals with self-employment income, certain levels of investment income, or those who owe taxes due to other reasons may also be required to file. It is recommended to consult the tax laws of the specific country for accurate and up-to-date information.

How to fill out tax taxes?

Filling out tax taxes involves several steps. Here's a general guide on how to do it:

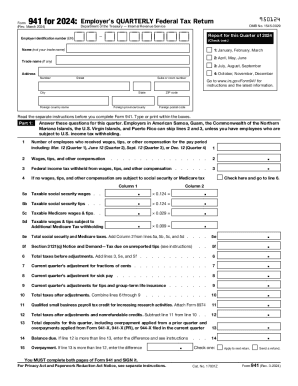

1. Gather necessary documents: Collect all the documents needed, including your W-2 forms (for income), 1099 forms (for freelance or contract work), receipts for deductible expenses, and any other relevant financial records.

2. Choose your filing status: Determine your filing status (e.g., single, married filing jointly, etc.) as it will impact your tax brackets and deductions.

3. Determine your income: Calculate your total income, which typically includes wages, salaries, tips, self-employment income, rental income, and investment income.

4. Determine your deductions: Consider taking either the standard deduction or itemizing deductions, depending on which one provides a higher tax benefit for you. Common deductions include mortgage interest, medical expenses, charitable contributions, and state and local taxes.

5. Calculate your taxable income: Subtract your deductions from your total income to determine your taxable income.

6. Determine your tax liability: Use the appropriate tax brackets and rates to calculate how much tax you owe based on your taxable income.

7. Review tax credits: Review available tax credits that can reduce your tax liability, such as the Child Tax Credit, Earned Income Credit, or Education Credits.

8. Complete tax forms: Fill out the necessary tax forms based on your income, deductions, and tax credits. This typically includes Form 1040 or 1040EZ, along with any additional forms related to specific deductions or credits.

9. Double-check for errors: Review your completed forms for accuracy, ensuring that all information is correct and calculations have been done accurately.

10. Submit your taxes: File your taxes electronically through the IRS website or mail your completed forms to the appropriate tax office. Ensure you meet the tax filing deadline (usually April 15th in the United States).

Note: It is always advisable to consult with a tax professional or use tax software to ensure accurate completion of your taxes and to take advantage of any recent tax law changes or deductions that may apply to your situation.

What is the purpose of tax taxes?

The purpose of taxes is to generate revenue for the government to fund public expenditure and provide necessary services and infrastructure for the welfare and development of the country. Taxes are essential to finance various public programs such as education, healthcare, defense, transportation, infrastructure, and social welfare initiatives. Additionally, taxes can also be used as a tool to redistribute wealth, promote economic stability, incentivize certain behaviors, and address social and environmental concerns.

What information must be reported on tax taxes?

The specific information that must be reported on tax returns can vary depending on the country and tax laws. However, generally, the following information is commonly required to be reported on tax returns:

1. Personal Information: Taxpayer's full name, Social Security Number (in the United States), or other identification numbers.

2. Income: Reporting all sources of income earned during the tax year, including wages or salary, tips, self-employment income, rental income, investment income, etc.

3. Deductions: Claiming deductions, such as mortgage interest, student loan interest, medical expenses, state and local taxes, charitable contributions, etc. The method for claiming deductions may vary depending on the tax jurisdiction.

4. Credits: Reporting any eligible tax credits, such as the Child Tax Credit, Earned Income Tax Credit, education credits, energy efficiency credits, and other credits provided by the tax law.

5. Tax Withholdings and Payments: Reporting the amount of income tax withheld from paychecks or other payments, estimated tax payments, and any other tax payments made throughout the year.

6. Filing Status: Indicating the taxpayer's filing status, such as single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child. The filing status can impact the tax rate and eligibility for certain tax credits and deductions.

7. Dependents: Providing information about any dependents claimed on the tax return, including their names, Social Security Numbers (in the United States), relationship, and whether they meet the qualifying criteria for dependents.

8. Signature: The tax return must be signed by the taxpayer or their authorized representative, certifying that the information provided is true and accurate.

These are general guidelines, and it is important to consult the specific tax laws and regulations of your country or region to understand the complete and accurate information required to be reported on tax returns.

When is the deadline to file tax taxes in 2023?

The deadline to file taxes in 2023 would be April 18th, 2023.

What is the penalty for the late filing of tax taxes?

The penalty for the late filing of taxes varies based on the jurisdiction, type of tax, and the total amount owed. In the United States, for example, if you fail to file your tax return by the deadline (usually April 15th), a penalty of 5% of the unpaid taxes is charged each month the return is late, up to a maximum of 25%. Additionally, if you fail to pay the required taxes by the deadline, an additional penalty of 0.5% to 1% of the unpaid taxes per month is charged. These penalties can accumulate quickly, so it is important to file and pay taxes on time to avoid them.

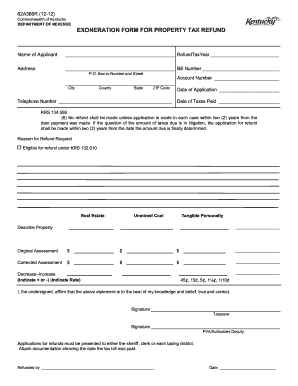

Can I create an electronic signature for the kentucky property tax refund in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out the kentucky revenue exoneration form tax form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign tax taxes. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How can I fill out kentucky exoneration property tax on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your kentucky dor exoneration form refund by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.