KY DoR 62A366R 2022-2026 free printable template

Show details

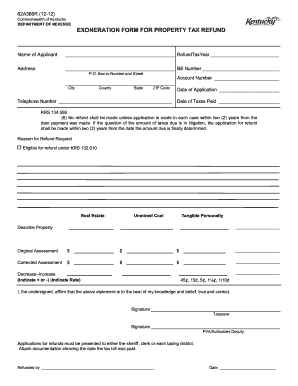

62A366R 9-22 Commonwealth of Kentucky DEPARTMENT OF REVENUE EXONERATION FORM FOR PROPERTY TAX REFUND Name of Applicant Refund Tax Year Address Bill Number P. O. Box or Number and Street City County State ZIP Code Account Number Date of Application Telephone Number Date of Taxes Paid KRS 134. 590 6 No refund shall be made unless application is made in each case within two 2 years from the date payment was made. If the question of the amount of taxes due is in litigation the application for...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign kentucky revenue 62a366r form tax

Edit your kentucky dor 62a366r form sample form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kentucky property tax refund form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kentucky revenue exoneration form property tax print online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit refund pay taxes form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR 62A366R Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out kentucky revenue exoneration tax refund form

How to fill out KY DoR 62A366R

01

Begin by downloading the KY DoR 62A366R form from the Kentucky Department of Revenue website.

02

Provide your full name in the designated section at the top of the form.

03

Enter your Social Security Number or Federal Employer Identification Number (EIN) as required.

04

Fill in the address where you reside or where your business is located.

05

Indicate the tax period for which the return is being filed.

06

Complete the appropriate sections for income details as per your tax type.

07

Calculate any deductions or credits and enter the amounts in the specified areas.

08

Review the form for accuracy, ensuring all necessary fields are completed.

09

Sign and date the form in the designated areas to validate it.

10

Submit the completed form to the appropriate office as indicated in the form instructions.

Who needs KY DoR 62A366R?

01

Individuals or businesses that need to report their income or claim deductions in Kentucky.

02

Taxpayers who are required to file state tax returns for the relevant tax period.

Fill

kentucky exoneration property tax

: Try Risk Free

People Also Ask about kentucky dor 62a366r tax form

What are the 3 main types of taxes?

The main difference is the point of collection. Sales taxes are paid by the consumer when buying most goods and services. Income taxes are major sources of revenue for the federal government and many state governments. Property taxes generate revenue at a local level.

What are the top 3 things taxes are used for?

The three biggest categories of expenditures are: Major health programs, such as Medicare and Medicaid. Social security. Defense and security.

When can I expect my tax refund 2023?

Most people with no issues on their tax return should receive their refund within 21 days of filing electronically if they choose direct deposit.

What do taxes tax?

What Are Taxes? Taxes are mandatory contributions levied on individuals or corporations by a government entity—whether local, regional, or national. Tax revenues finance government activities, including public works and services such as roads and schools, or programs such as Social Security and Medicare.

What are 3 types of taxes?

progressive tax—A tax that takes a larger percentage of income from high-income groups than from low-income groups. proportional tax—A tax that takes the same percentage of income from all income groups. regressive tax—A tax that takes a larger percentage of income from low-income groups than from high-income groups.

Do I have to pay IRS taxes?

Congress used the power granted by the Constitution and Sixteenth Amendment, and made laws requiring all individuals to pay tax. Congress has delegated to the IRS the responsibility of administering the tax laws known as the Internal Revenue Code (the Code) and found in Title 26 of the United States Code.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the kentucky dor form property tax refund in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out the kentucky revenue exoneration form refund edit form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign refund taxes overpayment. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How can I fill out kentucky revenue form property tax refund make on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your kentucky exoneration form property tax blank by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is KY DoR 62A366R?

KY DoR 62A366R is a form used for reporting specific tax-related information in the state of Kentucky.

Who is required to file KY DoR 62A366R?

Individuals or businesses who have certain taxable transactions or responsibilities in Kentucky are required to file KY DoR 62A366R.

How to fill out KY DoR 62A366R?

To fill out KY DoR 62A366R, you need to provide accurate information about your taxable transactions, complete any required sections, and submit the form to the appropriate Kentucky Department of Revenue.

What is the purpose of KY DoR 62A366R?

The purpose of KY DoR 62A366R is to facilitate the reporting of specific tax liabilities and to ensure compliance with state tax laws.

What information must be reported on KY DoR 62A366R?

The information that must be reported on KY DoR 62A366R includes details about taxable sales, purchases, and any applicable deductions or credits.

Fill out your KY DoR 62A366R online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ky Revenue Exoneration Property Tax Online is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.